This is the follow-up to my previous post about Traderino, a bot that trades cryptocurrency futures on Binance and reports his action on Telegram. Jump to the previous article if you want to know more, or keep reading to see what happened during his first week of simulated trading.

Timing has been far from perfect for Traderino’s public launch and first week of trading. He started his adventure right after the great Bitcoin crash, in times of high volatility and high uncertainty.

But whatever doesn’t kill you only makes you stronger, and now Traderino is ready to enter the arena again with newly acquired skills. However, before looking at what’s new, let’s stop and analyze what data we have collected and what we can learn from it.

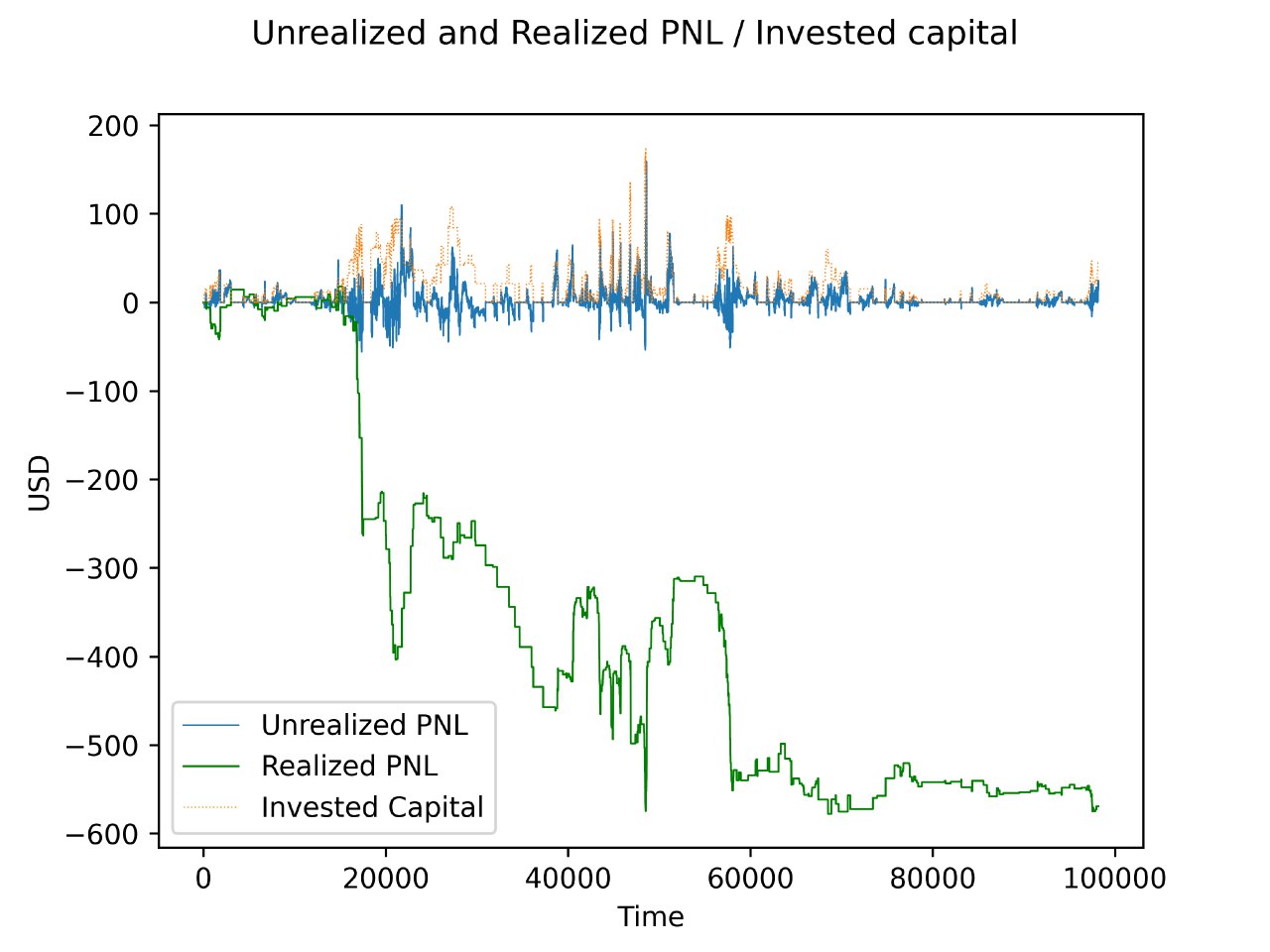

Analyzing Traderino’s performance

Let’s look at the closed positions recap:

He made 613 trades with an average of 2.6 trades per hour. As you can clearly see, most of the trades were losing, although he opened mostly SHORT trades.

As I already mentioned, market conditions were not ideal for a Supertrend-based strategy, however there has to be a way to at least minimize losses or improve performance overall in these kind of scenarios.

By looking the actual trades, one of the first thing I realized is that Traderino would hit a stoploss and then open the same trade again. This happens if the signal to enter the trade is still valid after you hit a stoploss, which can be the case very often especially on longer timeframes, where it takes more time for the current candle to close and invalidate the signal.

I’ve observed the history of trades for pairs like XRPUSDT and seen this behaviour in action, which cause great losses. I’ve now introduced a proper cooldown period, which depends on the current timeframe, that prevents Traderino from opening the same trade if it has been closed as a loss.

In some situations, we might miss some positive trades due to this rule, but I think, overall, the money it will save it’s going to be way more than what it could potentially make.

Adaptive Supertrend threshold

One of the problems with the Supertrend indicator (and all indicators for that matter) is that we can’t use its values as an absolute truth. Specifically, there are multiple instances where the price pierces the Supertrend line before bouncing or, conversely, bounces a few percentage points off, before even touching it. I was supposed to put some screenshots here but I’m too lazy for that, so you’ll need to observe this phenomenon by looking at the charts yourself.

For this reason, even if the Supertrend gives us a precise price level, it would be better to think of it like an area, where the line is kind of a middle point:

The most obvious thing to do would then be to enter at a fixed distance from the Supertrend line, say 2%. The problem with this is that, yes, you will get more trades (those who bounce before touching the actual line), but you’ll hit more stoplosses as well (those who pierce the line before bouncing) cause you entered too early.

Up until now, Traderino was entering positions at a very short distance from the supertrend, like < 0.2%, but slightly different across timeframes.

Since we cannot set a fixed threshold distance for the problem we just discussed, the only reasonable alternative is to make this threshold vary based on something else that can tell us whether we should adjust our threshold.

I decided to use Bitcoin volatility as an indicator. The reasoning being that if Bitcoin has high volatility to the downside, Traderino should be more inclined to take short positions, so if there is a short signal the threshold can be “relaxed” and instead of 0.2% maybe set to 2% or even 5%. The same applies in the other direction.

Without going into too much math about how exactly the threshold is set, let’s just say that it is computed from an average of Bitcoin volatility values over the last 3 hours. This value can then be used as our threshold distance to the Supertrend line.

This change makes the system way more dynamic because it adjust according the the Bitcoin price. In fact, it changes the behaviour of Traderino completely, as it takes a lot of different trades compared to the previous version.

There’s a parameter that allows us to control how much it will follow the Bitcoin movements: if the parameter is zero, then it will behave normally (the threshold distance will not be relaxed), conversely, the greater its value is and the more the bot will relax threshold and open trades. This will need to be tuned after observing how it goes.

Conclusions

That was the biggest change for this “release”, although I’ve also made several minor improvements and bug fixes, which should not impact trading too much.

The most important thing is the integration with Binance API, almost fully completed, in order to make the bot able to trade with real money when the time comes.

That’s all for now, see you next time and if you didn’t already join the Telegram channel!

Webmentions

The Creator Causal Design

The Creator Causal Design

Traderino and its first week of automated cryptocurrency trading

https://oliviascroutons.com/steamed-asparagus-with-olivias-parmesan-pepper-croutons/

https://yak-jiu.com/-cenforce.html

센포스 온라인 구매

Lider

Lider

dizain-cheloveka-manifestor.ru

dizain-cheloveka-manifestor.ru

hdmy.ru

hdmy.ru

HumanDesign2028.ru

HumanDesign2028.ru

Traderino and its first week of automated cryptocurrency trading

https://mooldhoka.com/2023/05/26/बालेन-शैलीमा-काम-गर्दै-पा/

Traderino and its first week of automated cryptocurrency trading

https://android35.ru/2019/08/08/дизайн-квартиры-в-санкт-петербурге/

Traderino and its first week of automated cryptocurrency trading

https://finalfilm.nl/uncategorized/test-2/

Traderino and its first week of automated cryptocurrency trading

http://ey5208.com/2019/11/01/台北外送茶line:ey5208/

Traderino and its first week of automated cryptocurrency trading

https://www.aceitescasablanca.com/blog/que-diferencia-hay-entre-el-aceite-de-oliva-filtrado-y-sin-filtrar/

Traderino and its first week of automated cryptocurrency trading

https://ibnts.com/index.php/products/eary-grey-3/

Traderino and its first week of automated cryptocurrency trading

https://advancedtimber.com.au/h2-treated-pine-price-reduction/

Traderino and its first week of automated cryptocurrency trading

https://tobylrok.pl/czy-wiesz-ze-24-pazdziernika-1965-roku-telewizja-polska-wyemitowala-premierowy-odcinek-serialu-komediowego-wojna-domowa-w-rezyserii-jerzego-gruzy/

Traderino and its first week of automated cryptocurrency trading

https://brucecorbin.com/tech-notes/

Traderino and its first week of automated cryptocurrency trading

https://natlas.co.id/ban-grader/

youtube-videos

youtube-videos

Traderino and its first week of automated cryptocurrency trading

http://mrddf.org/2019/06/06/sustainable-tourism-strategies-to-conserve-and-valorise-the-mediterranean-coastal-and-maritime-natural-heritage-inherit/

kamagra vente pas cher

medicament kamagra pharmacie en ligne en germany

vzorky zdarma kamagra poštou bez přepravného

kamagra přes noc

usa pfizer brand name itraconazole from pfizer

buy itraconazole online sydney

fildena on line cash on delivery

buy cheap fildena generic is good

buy gabapentin generic new zealand

price of gabapentin at a pharmacy

online order flexeril cyclobenzaprine generic no prescription

cheapest buy flexeril cyclobenzaprine generic real

buy dutasteride generic now

dutasteride free online doctor consultation

purchase avodart low cost

cheap avodart generic is good

buy cheap staxyn cheap europe

how to order staxyn generic in usa

how to buy xifaxan cheap online in the uk

buying xifaxan without a script

discount rifaximin generic from canada

rifaximin prices walmart

buy enclomiphene generic low price

online order enclomiphene cheap in uk

buy cheap androxal generic pharmacy canada

cheap androxal cost usa

dizain cheloveka

dizain cheloveka

lovehumandesign.ru

lovehumandesign.ru

axbb.ru

axbb.ru

Traderino and its first week of automated cryptocurrency trading

https://yupickauto.com/14-surprisingly-affordable-luxury-cars/

Traderino and its first week of automated cryptocurrency trading

https://binnacorp.com/binnablog/afrontar-el-covid-19-en-esta-nueva-convivencia-social/

tiktok

tiktok

groups

groups

tadalafil 20 walgreens price

cialis side effects a wife’s perspective

professorkorotkov.ru

professorkorotkov.ru

psycholog-korotkov.ru

psycholog-korotkov.ru

psikhologvyalte.ru

psikhologvyalte.ru

here

here

ekzistenczialnyj

ekzistenczialnyj

myprin92.ru

myprin92.ru

0410.ru

0410.ru

atvip.ru

atvip.ru

5yucMCMAAAAJ

5yucMCMAAAAJ

instagram.com/korotkovlakanfreud

instagram.com/korotkovlakanfreud

Sochi-psiholog-Russia

Sochi-psiholog-Russia

t.me/s/psy_chat_online

t.me/s/psy_chat_online

Forum

Forum

Traderino and its first week of automated cryptocurrency trading

https://estudifotolleida.com/2013/03/21/10-tips-for-what-to-do-downtown/

Traderino and its first week of automated cryptocurrency trading

https://equilibriumbdc.com/estudio-habitos-alimenticios-2021/

cheep cialis canada

cialis 20mg ????

Traderino and its first week of automated cryptocurrency trading

http://www.comake.nl/category/frezen-hout/

Traderino and its first week of automated cryptocurrency trading

https://reppureissu.com/kaupunkiesittelyssa-turku/

Traderino and its first week of automated cryptocurrency trading

http://appu.kharkov.ua/2021/04/27/погашення-узгоджених-податкових-зоб/

Traderino and its first week of automated cryptocurrency trading

https://blog.typoonline.com/10-kesalahan-penggunaan-bahasa-yang-sering-kita-jumpai-di-tempat-umum/

cialis dosage about

ivermectin 1 cream

Traderino and its first week of automated cryptocurrency trading

https://creativelair.co/beatum-inquit/

Traderino and its first week of automated cryptocurrency trading

https://writingsofthewarriors.com/welcome/

Traderino and its first week of automated cryptocurrency trading

https://fundacionlevanteud.org/el-levante-ud-la-fundacion-y-la-guardia-civil-estrechan-lazos-y-preparan-diversas-acciones-conjuntas/

Traderino and its first week of automated cryptocurrency trading

https://astroriviera.com/planetes-lentes-en-signe/

Traderino and its first week of automated cryptocurrency trading

https://kissana.com/2019/04/20/hello-world/

439W6fo

439W6fo

r2f.ru

r2f.ru

xblx.ru

xblx.ru

Traderino and its first week of automated cryptocurrency trading

https://catchip.com/faq-items/microchips-for-disaster-preparedness-any-tips/

Traderino and its first week of automated cryptocurrency trading

https://lesliebirch.com/2015/08/26/electronic-spiders-web-tech-art/

Traderino and its first week of automated cryptocurrency trading

http://miildoos.ru/ban/www/delivery/ck.php?ct=1

Traderino and its first week of automated cryptocurrency trading

https://www.meinbobbycar.de/bobby-car-next-tuerkis/

dilts.g-u.su

dilts.g-u.su

Traderino and its first week of automated cryptocurrency trading

https://ethiopianchurch.org/en/component/k2/item/80——-.html?start=11990

sitnikov

sitnikov

iu0000ytre

iu0000ytre

Traderino and its first week of automated cryptocurrency trading

https://pickledherring.org/blog/how-to-not-kill-yourself-when-bitcoin-crashes/

Free-Proxy-socks5-socks4.ru

Free-Proxy-socks5-socks4.ru

edu-url-http.ru

edu-url-http.ru

Traderino and its first week of automated cryptocurrency trading

https://www.f-tetsujin.jp/etc/9084/

imkor.ru

imkor.ru

ddfr.ru

ddfr.ru

pstat

pstat

where can i buy ketorolac for sale

where can i buy ketorolac for sale

how to buy toradol pills

how to buy toradol pills

artane 2 mg side effects

artane 2 mg side effects

djss.ru

djss.ru

iwbc.ru

iwbc.ru

[…] I’ve implemented the last update, Traderino has become very, very active. You can clearly see that he makes a lot of trades, and […]

[…] Update 31/05/2021: See how Traderino performed during his first week of trading […]